Are Identity Fraud Prevention and Customer Experience Competing Priorities?

Do you want to switch to our US site?

When COVID-19 struck, Australian lawmakers made some temporary changes to furthering Australia’s digital journey. See what the changes are...

While electronic signatures have been widely accepted as a secure and efficient approach of expressing consent for nearly 20 years, there are still some areas where wet-ink signatures are still used – often because some uncertainty remains.

As we make clear in a new eBook, Promoting greater usage of electronic contracts and electronic signatures under Australian law, Docusign is advocating for permanent reform in Australia. Alongside the Australian Banking Association, King & Wood Mallesons, one of Australia’s most innovative law firms, and other organisations, we’re supporting greater clarity so that businesses know exactly what’s what when it comes to electronic signing.

Let’s take a look at the main points of the eBook. If you want to dive deeper, download it today.

Areas of uncertainty

Despite the Electronic Transactions Act 1999 (Cth) affirming the broad applicability of electronic transactions and use of electronic signatures in Australia, certain specific types of transactions fall into a grey area:

Deeds - Heard the phrase ‘signed, sealed and delivered’? Its origins lie with deeds. Confidentiality deeds, deeds of release, indemnity deeds and more, are special contracts with unique rules – even down to the type of paper the document is printed on. While NSW has passed legislation to allow deeds to be signed electronically, other states haven’t yet passed permanent legislation.

s127 of the Corporations Act - When two corporate officers have to sign and execute a document under s127 of the Corporations Act, the jury’s out on whether it has to be a paper document.

Witnessing and attestation - Even legal eagles are unsure about how the signing of a deed can be properly witnessed and attested (in case you’re wondering, attestation is the recording on the document that the witness watched the other person sign the doc). For one thing, does the witness have to be physically present? And then, if an electronic signing platform theoretically creates a ‘new’ document for each new signatory, does that invalidate a witness and their attestation?

The frustrating thing about these grey areas is that they can overshadow the very real and tangible security and efficiency benefits of electronic transactions. So when, in response to COVID-19, some Australian jurisdictions decided to temporarily amend their laws to allow these last paper-based agreements to be signed electronically, we and the other organisations who are championing change started feeling hopeful.

Temporary changes to cope with COVID-19

When the pandemic hit and people retreated to their homes, Australian lawmakers realised that previous rules about wet-ink signatures for the abovementioned agreements were no longer practical. In many cases, it would prove impossible to get people together to sign documents.

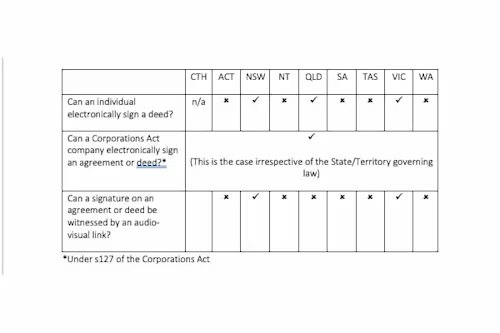

So Commonwealth, State and Territory legislators swiftly implemented temporary measures to make it easier for agreements to be signed. The rules are unfortunately somewhat inconsistent – as they vary from state to state. To help clarify things, here’s where the rules stand (as of the date of publication of this article):

Let’s make these changes permanent and wider-reaching

A recent article from the Australian Banking Association sums up the benefits that come with digital reform that addresses these specific digital use cases. “The temporary introduction of COVID-19 related measures such as electronic mortgages, witnessing a document over video call and signing documents electronically should be made permanent to save time, money and hassle for Australian customers.”

Members of the Association, as well as other bodies linked to the financial services and corporate sector, believe that the time has come for traditional methods of signing and witnessing title deeds, home loans and other financial agreements to be archived. While, once upon a time, witnessing a physical signature was deemed to be a secure, trusted way to capture someone’s intent, we’ve moved on. Technology now exists to make the process even more secure and trusted.

As Brad Newton, Vice President of APAC, Docusign, said, “When compared to a wet signature, electronic signatures are undoubtably more secure, providing greater protection and accessibility for customers. When combined with multi-factor authentication, identity management and embedded signing experiences, the technology offers additional safeguards from fraud and identity theft, particularly for vulnerable communities.”

Going digital helps to protect more vulnerable customers in the community, too. As Newton reflects, “We’ve seen countless examples where the availability of electronic signature has mitigated the risk of end customers experiencing financial loss or missed opportunities due to circumstances of location that are beyond their control. It’s not just a matter of convenience, it’s a matter of safety, security and accessibility.”

It’s why Docusign, the Australian Banking Association, King & Wood Mallesons and others are advocating for change. To learn more about what we’re doing, click here.

To learn more about the latest on electronic contracts and electronic signatures under Australian law, head here.

Related posts