Are Identity Fraud Prevention and Customer Experience Competing Priorities?

The fight against identity fraud requires a proactive approach. By investing in robust IDV solutions and staying informed about the latest threats, businesses can protect their bottom line, their customers, and their reputation. Download the full report today to learn more and take action.

According to a new global study by Docusign and Entrust, 66% of organizations believe the answer is yes. While the majority of business leaders agree that identity fraud attempts are becoming more common, with 10% incurring annual fraud costs over $10M USD, they are still grappling with big questions, like:

Where should organisations focus their efforts to prevent identity fraud?

What tools and solutions are the most effective?

How can organisations heighten security without compromising customer experience?

To answer these questions and more, Docusign and Onfido, an Entrust company, surveyed over 1,400 decision-makers in information security, risk management and compliance, operations, and more. The result is The Future of Global Identity Verification report, a deep dive into how leading organisations across industries and regions are balancing digital security with user experience to thrive in an era of increasing threats.

The report shares insights from organisations of all sizes and industries around the globe and includes the current costs of identity fraud, where identity fraud typically occurs in the customer journey, and the best methods for preventing and recognising identity fraud attempts. Digital identity verification (IDV) and authentication technologies have emerged as the leading solutions for this growing challenge.

Combatting identity fraud from all fronts

Digital transformation has brought about incredible convenience, but it has also opened the door to a new wave of identity fraud that is costing businesses millions. Many consumers are unaware of how to properly secure their online information, leaving businesses vulnerable to attack.

Generative AI has also made deception easier for fraudsters. They can more readily create deepfakes and commit identity fraud with this new technology—but it is also becoming a critical line of defence for organisations.

82% of business leaders surveyed believe generative AI will be more effective than their current methods at reducing customer fraud risk.

Key findings

Identity fraud takes a heavy toll

Far from a routine expense, identity fraud costs businesses an average of $7 million usd each year. Direct costs like chargebacks, refunds, and other financial losses are to blame, along with the indirect costs of addressing reputational damage and channeling employee resources toward fixing the problem. As incidents of fraud continue to rise, these costs will only grow unless businesses take action.

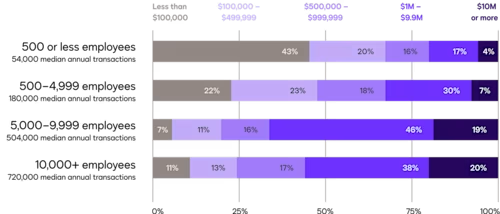

The survey found that large organisations face the highest expenses. Organisations with more than 5,000 employees have an annual identity fraud cost of $13 million USD on average, and 20% of organisations with over 10,000 employees have annual identity fraud costs of over $50 million USD.

Large organisations see higher direct identity fraud costs

If you had to estimate, what is the approximate annual direct financial cost of customer fraud for your organisation? By direct financial cost, we mean the amount of money lost because of fraud, regardless of whether you’re compensated by insurance.

Identity fraud is most common during customer login and payment authorisation

Identity fraud occurs throughout the customer journey, but businesses most often catch it when customers log in to their accounts and authorise payment. Additionally, username and password is the authentication method associated with the most fraud—more than sign-in links, manual ID checks, and single-sign on.

Fortunately, there’s a way to mitigate this risk: Organisations that use IDV detect fraud earlier and in 20% more stages of the customer journey than organisations that do not use IDV, making it an essential tool in guarding against threats.

Investing more in IDV pays off

$8 million: The total amount the average organisation saved by investing in IDV.

Organisations that prioritise IDV aren’t just protecting themselves; they’re reaping significant rewards. These forward-thinking organisations are:

Saving more money

Enjoying greater internal satisfaction with their identity fraud prevention solution

Seeing improvements in brand perception

Reporting a competitive advantage in their field

77% of organisations surveyed that invested significantly more in IDV than their peers have saved over $1 million USD in total, compared to 36% that invested the same as their peers.

Technology is the best path forward.

When asked how they plan to mitigate the risk of identity fraud, organisations agreed that robust investment in technology is the best solution. Some organisations noted concern that implementing identity fraud prevention steps will add friction to the customer experience, but this does not play out in practice: businesses that invest significantly in IDV are 1.6 times more likely to have had a positive impact on their brand.

With that in mind, it makes sense why 78% of organisations plan to invest more in IDV solutions in the future. Just as many believe that innovative technologies like generative AI (82%), biometric authentication (84%), and risk-based assessments (78%) will play an important role in reducing the risk of customer fraud.

What’s more, the younger generation is embracing IDV solutions for their convenience and seamless integration into their digital lifestyles. As time goes on, this demographic will increasingly expect to engage with IDV solutions as part of their day-to-day.

Preparing your business for the future

As threats advance, including those from AI, and the costs of identity fraud rise, businesses that vigorously invest in IDV will see enhanced brand perception, higher satisfaction, and greater ROI. Businesses need to take charge and use preventative measures; identity fraud prevention technology is the first and best line of action.

The fight against identity fraud requires a proactive approach. By investing in robust IDV solutions and staying informed about the latest threats, businesses can protect their bottom line, their customers, and their reputation. Download the full report today to learn more and take action.

Docusign IAM is the agreement platform your business needs