Orchestrate Better Agreement Experiences with No-code Automation

Automating the agreement management process empowers your team to accelerate transactions, close more deals, and build brand loyalty.

At the heart of nearly every business process is a series of contracts or agreements. Whether you’re buying and selling goods and services or hiring top talent, odds are that agreements are involved. Despite their importance to countless business teams and functions, the agreement process has yet to be automated like other processes have with CRM and ERP tools, for example. Your CRM might be great for sales, but not quite agreement management.

Outdated agreement processes can dramatically impact your customer and employee experiences. When customers are repeatedly asked to enter the same data or follow lengthy steps for account onboarding and updates, they’re more likely to grow frustrated with your brand. This frustration results in slower deals, decreased spending, and even disengagement. In a recent Deloitte and Docusign study, 66% of respondents cited inefficient agreement workflows as a driver for negative customer satisfaction.

Complexity leads to bad experiences

The customer journey is often delivered by various solutions and manual steps. IT teams face significant challenges in automating agreement workflows due to the complexity of integrating disparate systems and the high demand for their expertise and skills across other parts of the business. It’s difficult, if not impossible, for a disjointed internal process to provide a seamless experience for customers.

Creating end-to-end agreement workflows is often critical for organizations, but it’s challenging to find a streamlined solution that builds, connects, and automates the flow of activities across systems, applications, and teams. Without automation, organizations lean heavily on manual, time-consuming, and error-prone data entry and transfer processes, making it difficult to scale.

As a result, many businesses maintain the status quo at the expense of their customers and the bottom line. According to Qualtrics, 50% of consumers decrease or cut spending entirely with a brand after one bad experience.

Automate and accelerate agreements without code

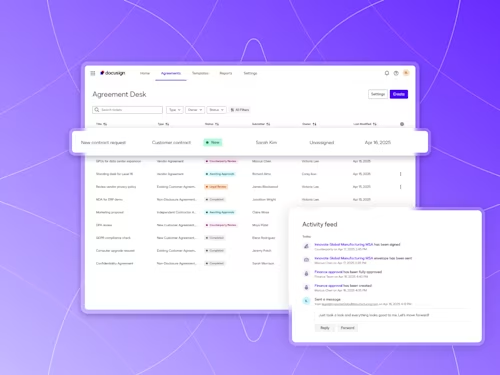

Meeting customers’ desires for fast, easy, and convenient experiences shouldn’t require lengthy implementations. Docusign Maestro enables anyone on your team—from ops leaders to product managers to Docusign admins—to easily build customized workflows and connect to critical business systems for seamless account signups, updates, and more. Here are a few ways Maestro can help your business:

Extend workflows by connecting to partner apps from the Docusign App Center like Salesforce, Microsoft, and HubSpot

Track and record tasks at every step of the agreement process for greater visibility

Lower costs by eliminating expensive coding time

Close deals faster through seamless, customer-friendly processes

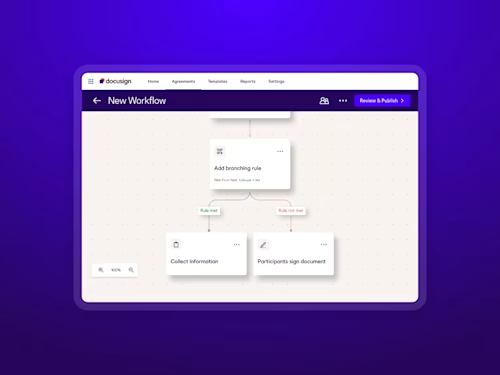

Maestro helps you automate tedious steps in the agreement process—from creating to signing and managing—without the need for expensive technical resources. For example, you might want to verify a signer’s identity before collecting their signature or automatically kick off tasks post-signing. Maestro makes these actions possible with just a few clicks.

Maestro streamlines customer experiences

From automating quote generation to expediting transactions, the potential use cases for Maestro are virtually endless. Here are a few ways businesses use Maestro to accelerate agreement processes and improve customer experiences.

Set up automatic payment authorization

One of the most popular customer experience workflows involves automatic payment authorization. To set this up, a Docusign admin or other employee with access permission logs into Docusign, selects the “Workflows” tab and clicks “Create workflow.” Then, they follow the easy-to-understand prompts on the screen to build the workflow.

With Maestro, businesses are transforming the payment authorization process from slow and cumbersome to fast and seamless. For customers, the updated experience often looks something like this: the customer visits the business’ website and selects automatic payment authorization from the website navigation menu. Now the Docusign workflow commences. ID Verification snaps a picture of the customer’s government-issued ID and verifies their identity. Then Docusign Web Forms kicks in, with many fields pre-filled with customer data from an existing Salesforce record. The customer simply adds any required information and signs using Docusign eSignature, which is also built into the agreement flow.

The customer’s tasks are now complete, but the process for your business automatically continues. Maestro extracts data from business platforms like Salesforce and writes data back to them. The result: your Salesforce record is automatically updated with any new data entered by the customer, and completed agreements are archived in a database like Google Drive.

Automate quote generation

Maestro is also helping organizations deliver a more modern customer experience through automatic quote generation. OnTrack 401(k), a retirement investment advisor, saw firsthand how a slow quote generation process impeded its team’s ability to fully capture new business. After state mandates led to a jump in employers seeking 401(k) plans, the company needed to quickly expand its capacity to respond to prospects and onboard new customers.

OnTrack 401(k) turned to Docusign to automate the quote generation process and deliver a high-quality customer experience. Using Maestro, the company launched a new workflow that automatically collects critical customer information, generates quotes, and updates customer records in Salesforce. Maestro gave OnTrack 401(k) control and autonomy over its processes to quickly adapt to changes without relying on technical resources.

With Maestro, Ontrack 401(k) quickly innovated to seize new growth opportunities—all without writing a single line of code.

Streamline transaction processes

In the fast-moving real estate industry, speed and efficiency are essential. Coldwell Banker, a leading national real estate franchise, wanted to streamline its transaction-pending process. Before Maestro, agents followed a lengthy paperwork process that required them to enter the same data in multiple steps for the same offer.

Coldwell Banker used Maestro to modernize this process through a custom workflow and save its agents hundreds of clicks. Now, after an offer is submitted, Docusign gathers essential data about the offer, pre-populates documents for signing based on financing options, and stores the completed agreements in Google Drive.

Using Maestro, Coldwell Banker agents spend less time completing manual, administrative tasks and more time selling properties, serving clients, and closing deals.

Better customer experiences begin with Maestro

These use cases show how Maestro can have a major impact by streamlining workflows for better customer experiences. Along with delighting customers, automating the agreement management process empowers your team to accelerate transactions, close more deals, and build brand loyalty.

Intelligent Agreement Management (IAM) is a new category of AI-powered cloud software that helps streamline and automate agreement processes. Maestro is only available in Docusign IAM applications and is the only platform dedicated to end-to-end agreement management.

Ready to rethink your agreement workflows? Learn how Maestro can help you work smarter and faster without code.

Related posts

Docusign IAM is the agreement platform your business needs