Modernize Wealth Management Systems and Serve Next Generation Investors

E-signature and contract technology can help wealth managers deliver more personalized and digital experiences to attract new investors.

Wealth managers today must navigate a dizzying amount of change to successfully capture and retain new business. To start, the great wealth transfer is underway, marking the passage of $70T+ in assets from boomers to millennials. This next generation of investors sets a higher bar for their wealth managers, expecting experiences that are more personalized and digital. While technology today has become intertwined into our consumer experiences, the same cannot be said for wealth management. Indeed, 50% of younger investors believe their wealth managers are falling short on digital capabilities.

Demographic changes are also impacting advisors. As advisors retire, competition is ramping up not only for next-gen talent but also for the book of business of these retiring advisors. This trend is part of what has fueled record-high M&A activity in the past few years, with pressures on margin and expansion of portfolio offerings being other key drivers.

To succeed in this environment, wealth managers need a cloud-based technology foundation in place to be agile and deliver differentiated digital experiences. Presently, however, many firms rely on legacy systems and disconnected point solutions. Manual workflows and mountains of paperwork are commonplace, resulting in slow, repetitive, and frustrating experiences for both wealth managers and their clients.

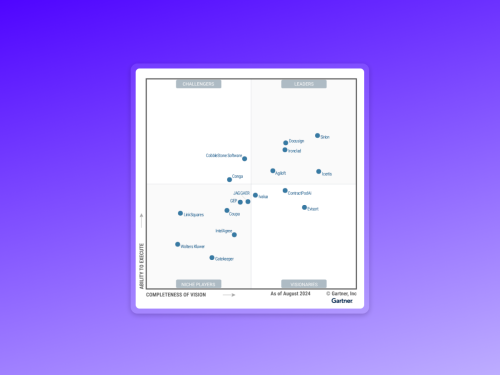

A modern, integrated tech ecosystem allows wealth managers to centralize their critical functions, enhance the flow of data between systems, and improve advisor productivity and client experience while supporting compliance requirements. Docusign and its ecosystem of partners, including Salesforce, Skience, and Quik!, come together to deliver a more streamlined, straight-through process for firms. Wealth managers can map data from Salesforce into their investor and custodian forms, integrate e-signature and contract management capabilities, and perfect their workflows with 360-degree visibility into financial accounts and data.

Manas Baba is a product marketing manager for the financial services industry at Docusign.

Related posts

Discover what's new with Docusign IAM or start with eSignature for free