AI Contract Agents and the Future of Agreement Management

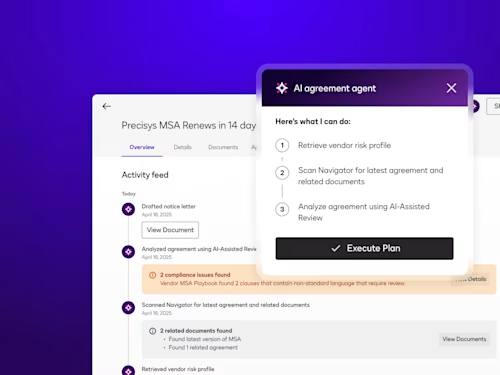

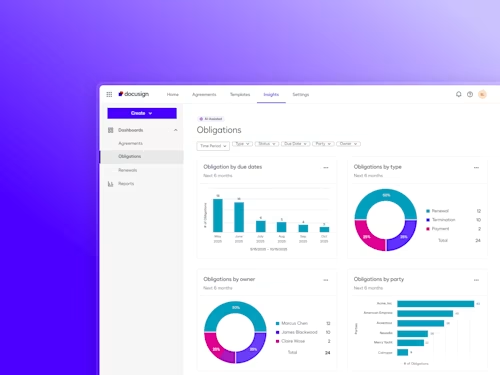

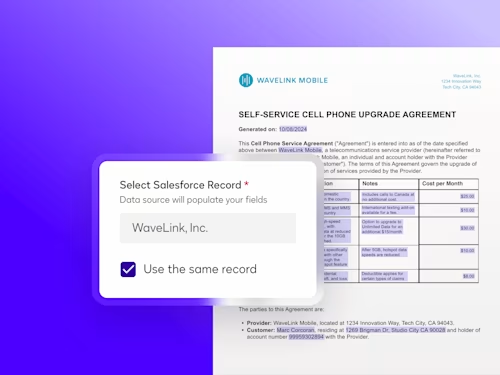

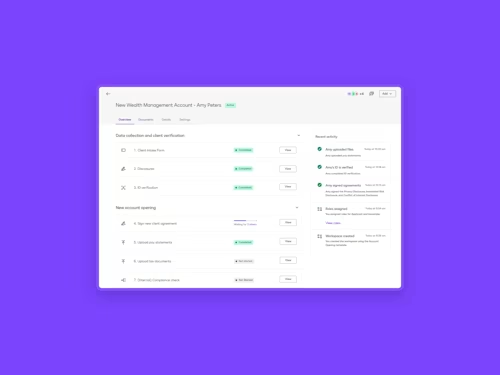

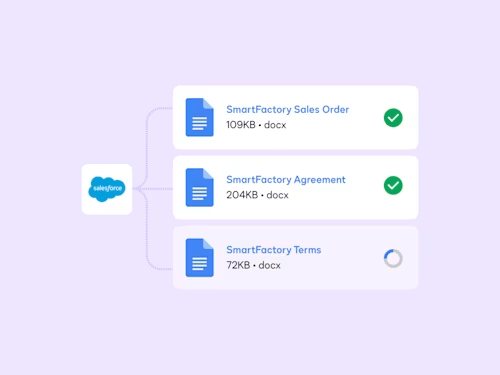

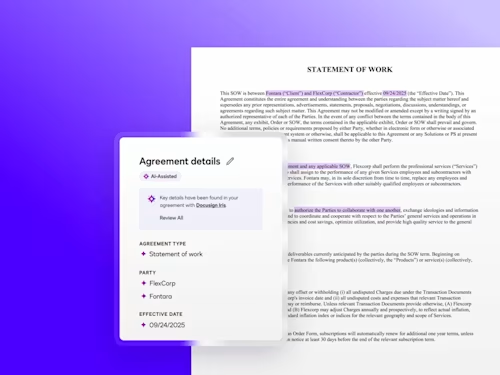

At Momentum25, we unveiled exciting new product updates, including the first AI contract agent designed to accelerate workflows, reduce risk, and achieve better outcomes across the entire agreement lifecycle.