Navigating DORA Regulation Compliance with Docusign: Facilitating Digital Operational Resilience for Financial Services

In this blog, we explore what DORA entails and how Docusign’s solutions and services can help organisations be compliant across its key pillars.

In an increasingly interconnected world, the resilience of information and communication technology (ICT) systems is critical for businesses, especially within the financial sector. The European Union’s Digital Operational Resilience Act (DORA), set to come into effect on 17 January 2025, is aimed at ensuring that financial institutions, along with their ICT service providers, can withstand, respond to, and recover from all types of ICT-related disruptions. DORA's requirements range from incident reporting to third-party risk management, making it essential for businesses to be prepared.

What is DORA?

DORA regulation, enacted by the European Parliament, aims to strengthen the digital operational resilience across the EU for financial institutions. It applies to a wide range of financial services entities (including banks and payment service providers), as well as their ICT service providers (regardless of whether they are located in the EU or not). EU DORA regulation focuses on ensuring that these organisations can remain operational through ICT-related incidents, such as cyberattacks, system failures, or third-party breaches. Its core pillars include:

ICT Risk Management

Incident Management and Reporting

Digital Operational Resilience Testing

ICT Third-Party Risk Management

Information Sharing

How Docusign Can Support Your DORA Compliance

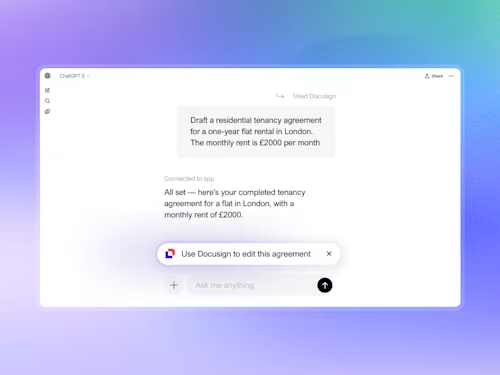

Docusign offers a range of tools that can assist financial institutions and ICT service providers in meeting the stringent requirements of DORA.

1. Docusign Intelligent Agreement Management (IAM): Managing ICT Third-Party Risk

DORA places a significant emphasis on ICT third-party risk management, requiring financial institutions to assess and manage risks associated with their ICT service providers. Docusign’s Intelligent Agreement Management (IAM) platform streamlines third-party risk management and supports ICT risk management, helping financial institutions meet DORA compliance.

With Docusign IAM Navigator, organisations can:

Classify and Identify Contracts in Scope: AI capabilities can help organisations efficiently identify and categorise ICT service providers’ contracts that fall under DORA’s scope. This enables teams to quickly focus on the contracts with their critical ICT service providers that present the most significant risks.

Remediate Pre-Existing Agreements: Organisations can generate amendments, either individually or in bulk, including all necessary contractual clauses required under DORA. These amendments can be issued to ICT service providers to initiate negotiations or signatures, all managed seamlessly within the IAM platform.

Update Contracting Standards for New Agreements: Docusign IAM also allows organisations to update their contract templates and standards to align with DORA’s new regulatory requirements. This ensures that any new agreements entered into with ICT service providers are fully compliant from the start, reducing future risk and manual oversight.

By automating the identification, amendment, and approval processes, Docusign IAM not only ensures compliance with DORA but also helps organisations manage ICT third-party risk more effectively and efficiently.

2. Docusign Monitor: Strengthening ICT Risk and Incident Management

ICT Risk Management and Incident Reporting are fundamental elements of DORA compliance. Organisations are required to have robust systems to detect, manage, and report ICT-related incidents to improve their overall cybersecurity

Docusign Monitor enables real-time monitoring of your Docusign account, offering visibility into potential cybersecurity threats and abnormal behaviour patterns. By incorporating Docusign Monitor into your security logging and monitoring strategy, you can swiftly detect unusual activities, enabling early response to potential cyberattack.

With Docusign, financial institutions can manage critical ICT contracts and ensure business continuity planning, in line with DORA’s requirements

3. Docusign Trust Center: Supporting Digital Operational Resilience Testing

Another critical aspect of DORA regulation is Digital Operational Resilience Testing. Financial institutions are expected to validate the operational resilience of their ICT systems regularly, including their ICT service providers.

The Docusign Trust Center provides you access to the latest Docusign security, compliance, privacy and system performance information that can be used to help validate our services under your DORA compliance obligations. As an ICT service provider, Docusign’s ongoing commitment to robust cybersecurity measures ensures that your agreements and documents are protected against cyberattacks

Preparing for DORA with Docusign

As financial entities strive to meet DORA requirements, Docusign is here to provide robust support. Our solutions are already helping organisations streamline their compliance efforts and automate critical processes for more efficient, reliable reporting.

In 2022, Docusign implemented Contract Lifecycle Management (CLM), part of Docusign’s IAM platform, for a global financial data provider, and in 2024, we are helping them automate DORA compliance by identifying contracts with their top 250 ICT service providers, extracting key data for integration into their data warehouse. Daily data extraction workflows will ensure ongoing compliance and operational efficiency.

Similarly, a European public transport pension fund, using CLM since 2023, is building a DORA-compliant database. They are also leveraging Docusign CLM to negotiate and manage DORA-specific addendums with their suppliers—differentiating between important and critical ICT service providers, whilst reducing the time to come to an agreement.

The countdown to the Digital Operational Resilience Act (DORA) compliance is on, and financial institutions should be taking steps now to ensure they are ready. Docusign’s comprehensive suite of solutions can provide the tools needed to meet DORA’s requirements—from ICT risk monitoring and third-party contract management to resilience testing and knowledge sharing. By leveraging these tools, your organisation can navigate DORA's regulatory landscape with confidence.

Ready to ensure DORA regulation compliance and enhance your operational resilience? Learn how Docusign’s solutions can support your journey in achieving DORA regulation requirements.

The information on this site is for general information purposes only and is not intended to serve as legal advice. Laws governing the subject matter may change quickly, so Docusign cannot guarantee that all the information on this site is current or correct. Should you have specific legal questions about any of the information on this site, you should consult with a licensed attorney in your area.

Related posts

Docusign IAM is the agreement platform your business needs