Popular posts

Delight Financial Services Customers with Frictionless New Account Openings

Learn how to streamline the new account opening process and facilitate seamless, easy electronic fund transfers.

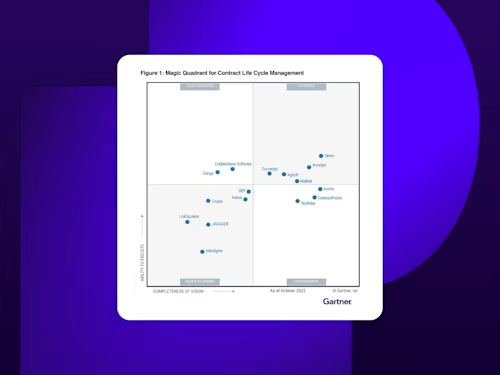

Discover how organisations grow with Docusign

Agreement strategies and insights - delivered straight to your inbox

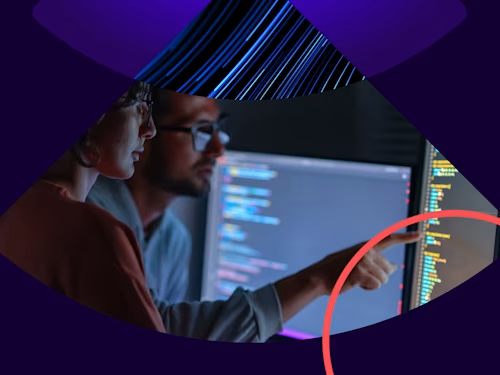

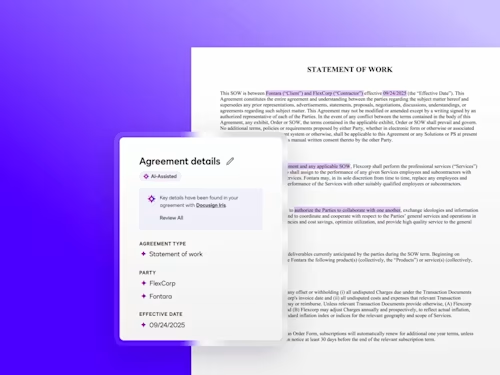

Docusign IAM is the agreement platform your business needs