Shaping the future of banking and financial services in Hong Kong: A Docusign primer for developers, Part 3

Forget copy-and-paste. In banking and financial services, it’s too error-prone. Instead, discover how Docusign Document Generation helps mitigate risk and save time in the creation of complex business agreements.

By Charlie Loo, Principal Solution Consultant, Docusign

Developers often come to us with questions about how to take their adoption of Docusign to the next level. In this series of blog articles, I walk you through a common use case in the banking and financial services sector. Previously, I wrote about using Docusign for account openings and identity verification. To wrap up this series, I explore how it helps with document generation.

—

Ctrl-C + Ctrl-V (or ⌘-C + ⌘-V if you’re a Mac fan) is a winning combo. Arguably the most powerful and commonly used set of shortcuts on our keyboards, the pair helps us save time and work more efficiently, simplifying the process of sharing information across different documents or applications. Yet when it comes to legal contracts, business agreements and financial documents, copy-and-paste comes with a big risk: the propagation of inaccurate and often outdated information from one source to many.

Think about it. In the Banking, Financial Services & Insurance (BFSI) vertical, agreement accuracy is critical — particularly when it comes to terms like interest rates, minimum account balance, overdraft limits, timelines, and liabilities. If left unchecked, a careless mistake due to copy-and-paste can lead to misunderstandings, disputes and even financial and reputational damage.

Thanks to digitalisation, modern-day banking systems and applications have been redesigned to reduce and, to a very large extent, eradicate the use of the copy-and-paste function. Operationally, this lowers the risk of staff making costly mistakes during transactions.

Online forms can now be pre-filled with customer’s personal details, taken from either the bank’s eKYC database or from the government’s registry, such as Hong Kong IAM Smart. This eliminates the need for the customer and the bank teller to fill in the information manually (a common scenario where copy-and-paste is rampant). Instead, all the customer needs to do is tick a checkbox and hit ‘submit’ to give consent to execute a transaction online.

But what if the banking use case is more complex, and a more formal sort of consent (e.g. signature) is required? Consider this three-step scenario:

A document containing the customer’s personal details (e.g. full name, ID Card No., residential address) needs to be generated and signd

The document also needs to be personalised based on the customer’s inputs or particulars (e.g. if employment status is self-employed, show additional terms and conditions)

The signed document needs to be routed to a downstream process as a proof of the transaction (e.g. in-principle credit/loan approval for land purchase)

This is where Docusign’s Document Generation for eSignature comes in handy. Developers tasked with extending the banking application’s capabilities to include both document generation plus electronic signature execution can do it all on a single platform, Docusign eSignature.

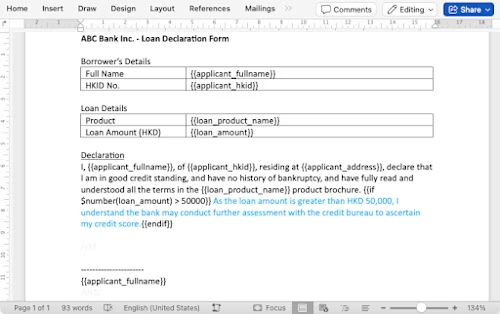

Let’s imagine we have a loan declaration agreement that the customer needs to sign before his application can be processed. A sample template could look something like this:

If the loan amount were to exceed HKD 50,000, an additional clause (in blue) is then appended to the declaration.

Using the Docusign Template Assistant for Microsoft Word, we can easily create a template, preview it and upload that into Docusign eSignature.

In this example, we will create a new envelope template in Docusign.

To confirm the Document Generation for eSignature template is successfully uploaded into the Docusign account, simply navigate to the template, open it and check for the label “Document Generation” pegged to the template document.

When everything is set, the banking application is now ready to invoke the Docusign eSignature REST API, passing the data as a JSON payload, to (a) kickstart the document generation process and (b) initiate the signing ceremony. A sample API guide on how to request a signature by email is provided in the Docusign developer portal.

The result? The generated agreement is professionally presented and formatted, along with the conditional clause (due to the loan amount being greater than HKD 50,000 in this example).

3 benefits of using Document Generation for eSignature

Firstly, developers no longer have to struggle with the heavy lifting of template parsing and document generation. With Docusign, data from the banking application is merged neatly into the document, producing a clean, professional agreement. No more ugly tags which can conceal the template text or get truncated when the data gets too lengthy.

Secondly, developers can leverage Docusign to deliver a more scalable solution and achieve faster time-to-market. Through simple configuration using the Docusign Template Assistant for Word, we can easily show and hide paragraphs of text (otherwise known as conditional formatting) and eliminate the need to create multiple variations of the same agreement template.

Lastly, when there’s a dispute and evidence is required, the signed PDF along with the Certificate of Completion can be downloaded from the Docusign account and submitted as court admissible documents. The agreement owner can do this quickly and easily, without having to ask the developers to extract records and generate reports from the banking application.

I hope you’ve enjoyed this blog series on how banks and financial institutions get the most from Docusign. If you’re keen to learn more, visit the Docusign developer portal.

Or, for a recap on my previous blogs, read Part 1 and Part 2 now.

Docusign IAM is the agreement platform your business needs