Catch up on the latest digital reforms around the legality of electronic signatures

Section 127 of the Corporations Act recently changed to allow electronic signing. As this webinar explored, it’s an important step in updating old legislation.

In February 2022, the Corporations Amendment Bill 2021 passed both Houses of the Australian Parliament and further broadened the use of electronic signing in Australia. It marks an exciting step forward, and will help reshape the way businesses operate.

To explore what the changes mean to Australian businesses and organisations as they adapt to the digital age, Docusign’s Adam Maloney recently hosted a webinar with Professor Veronica Taylor, Professor of Law and Regulation, School of Regulation and Global Governance, Australian National University; Kate Koidl, Partner, Mergers and Acquisitions, MinterEllison; and Docusign’s Doug Luftman, VP and Deputy General Counsel – Product, Innovation Services & Government Affairs.

You can watch the webinar on-demand now. Or, for a quick recap on what was discussed, read on.

First, what makes an electronic signature legal

Adam kicked the webinar off with a quick recap of the legality of electronic signatures. As he explained, eSignatures can take many shapes and forms. They’re only considered legal if they can:

Assure the signer’s identity – for example, is the signer who they say they are? Can you attribute the name to the eSignature in an acceptable way?

Meet specific compliance requirements – different types of transactions have different rules and laws applicable to them, so what may be considered legal for one document may not be for another.

Be admissible – can the record be considered evidence? Do you have a reliable method of capturing and maintaining the record?

When they tick these boxes, electronic signatures stand apart as a secure, traceable way to capture a person’s intent. More effective than a pen-and-ink mark, they tie the signature to an actual date and time, link it to an email and IP address, and can also include robust ID verification.

Veronica also weighed in on the benefits of electronic signatures, focusing on the security and fraud control aspects. “A squiggle on a page isn’t particularly secure, and our research shows that being in the room signing in ink doesn’t reduce fraud or enhance the veracity of the document. If you’re committed to fraud, you’ll do it. Digital tools preempt that opportunity for fraud by making the signature and the checking of ID of the person signing clear and secure up-front. This is an important benefit for high-risk transactions.”

Benefits like these point to why governments across the globe are now advocating for the legality of electronic signatures.

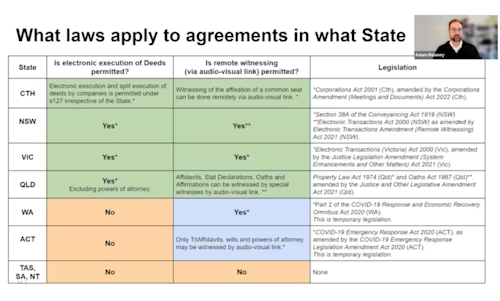

The complexities of the regulatory landscap

As alluded to in the points above, not all agreements are created equal. And, unfortunately, not all states legislate in the same way, either. It’s why the current legal landscape for eSignatures in Australia is quite complex – as the table below shows.

“It’s a complex landscape because there’s such a wide range of documents. From Power of Attorney documents to deeds, all these different types of documents were developed at different times, and are governed by different legislation. The Commonwealth and states are moving at different speeds, so we don’t have consistency,” said Veronica.

The reforms to the Corporations Act mainly apply to B2B transactions, making it possible for businesses to execute agreements and deeds using eSignatures, without the need for witnesses. But agreements between individuals and government entities are another story; as are non-business agreements like Wills and Power of Attorney documents.

“It’s still a challenge to deal with these remaining categories. There’s catch-up required for agreements between entities that aren’t corporations,” said Veronica. “Yet we need to be doing this – electronic signatures are a form of efficiency. With the Australian economy facing significant headwinds, why wouldn’t we make these processes as quick as they could be. Digitising documents could deliver double-digit million dollar savings. Who wouldn’t want that?”

Kate agreed. She said that while there’s a definite trend towards electronic execution, many transactions are still signed physically. “The key headwind is legislative inconsistency. Where you’re outside the swimlane of signing under the Corporations Act, there’s still uncertainty in the market.”

Looking overseas at legislative change

The changes that are occurring in Australia are not unique. Governments around the world are grappling with how to leverage digital tools to help transform agreements and processes. As Doug said, “To get there, it’s about people recognising that a qualified electronic signature could replace the witnessing requirement, and ensuring that the tool is adequate to establish the identity of signers.”

Doug cited the example of remote online notaries in the US. In the past, the premise has been that notarisation requires physical witnessing and stamping of documents. “Traditional signing ceremonies had a lot of presumed value. But, in reality, a person coming into your home and stamping a document has no evidence they follow the right processes. Remote online notary combines video screening and digital signing in an end-to-end process of how people should sign and witness in one transaction,” he said.

Looking ahead at how we can drive further reforms

Veronica advocated for the urgent review of the Digital Transactions Act, saying the 20-year-old piece of legislation needs to be refreshed to bring it into line with the available technologies today. “New technologies and better insights mean we can co-design documents and processes going forward. We can customise them for people with vulnerabilities, or culturally diverse groups, or particular use cases. By harvesting insights from research, industry, legal practitioners and design consultants, we can create new forms of document execution that are more efficient,” she said.

Kate concurred, saying that it’s time for more businesses and organisations to embrace electronic execution. “We need to advocate for legislative consistency outside Section 127 of the Corporations Act, and encourage more people to open their minds to new ways of doing things.”

Docusign is here to help. As Doug said, “Whether through law firms, research bodies, advisors, we’re all ears. We’re here to help make transformation a priority.”

To learn more about the recent legal changes and to hear the Q&A at the end, you can watch the webinar on-demand at any time. For questions about specific types of agreements and the legality of electronic signatures, get in touch with our sales team. We’re here to help.

Related posts

Discover what's new with Docusign IAM or start with eSignature for free