loanDepot Streamlines End-To-End Loan Process with the Docusign Signature API

loanDepot has become the second-largest non-bank lender in the US.

loanDepot has become the second-largest non-bank lender in the US. To focus on a highly-personalized customer experience, loanDepot relied on technology to take a different approach to lending. So how do you take that personalized experience and make it completely digital? loanDepot built a new customer portal from the ground-up, using the Docusign #API to manage the entire workflow – including eSignature – to create a great customer experience. The API integration has made the whole experience much more than simply viewing documents; it includes all document management capabilities and enables customers to communicate with loan officers in a seamless, digital way. According to Mark Hansen, VP of Business Application at loanDepot, signing documents electronically is the “cherry-on-top” of that experience.

When Good Isn’t Good Enough

In early 2014, loanDepot created and launched its own secure document exchange portal. The portal enabled borrowers to supply requested information by downloading, printing, then faxing or mailing signed documents.

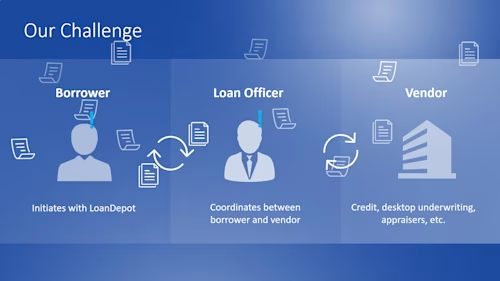

However, to extend the customer experience, loanDepot set out to significantly enhance the customer portal with eSignature and workflow routing capabilities by the end of 2014. The goals of the new version of the customer portal, outlined in Figure 1, include:

Guiding the customer through all aspects of the loan process.

Delivering a simple customer experience.

Ability to view, upload, and sign documents 100% digitally.

Communicating and coordinating with the loan officer.

Managing the workflow between all required parties in the transaction, including borrower, loan officer, lender, underwriter, and appraiser.

Figure 1: loanDepot needed a Contract Portal which seamlessly connected borrowers, loan officers, and all the vendors involved in the complex mortgage origination, approval and close process.

Empowering Disruption with Technology

loanDepot selected the Black Knight Financial Services Loan Origination System (LOS), called LoanSphere Empower®. Empower is the backbone of all projects at loanDepot. Integration to Empower is very flexible, but is also complex. loanDepot had to figure out how build the next generation of their customer portal to integrate with Empower and achieve all of their objectives. The key was to decouple the complexity of the LOS into discrete functional components, using trusted vendors for each piece. loanDepot selected Docusign for its robust eSignature API, secure platform, and its ability to easily handle the volume of transactions that loanDepot expected. Another reason loanDepot selected Docusign was that the Signature API was well-documented and easy to work with. Their development team had no difficulty in incorporating eSignatures into its customer portal. In fact, of the approximately four months of development time, only three weeks were spent developing with the Docusign eSignature API. Docusign Templates were implemented because loanDepot already had a welcome package with a known format.

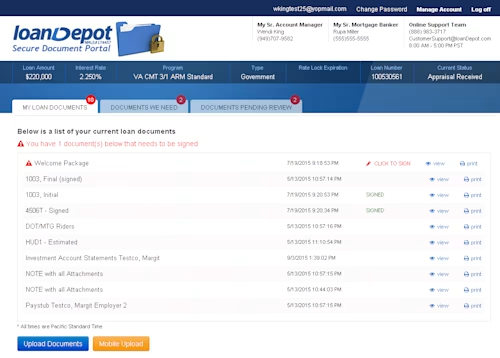

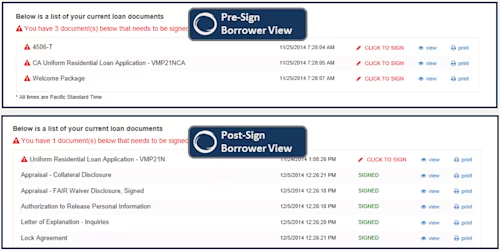

The new loanDepot customer portal experience, shown in Figure 2, gives customers one complete view of all the information and documents related to their loan. It enables the customer to begin the initial welcome process by viewing and signing a set of three basic documents (shown at the top of Figure 3). After the three basic documents are signed and completed, the Docusign envelope is broken into multiple parts, depending on what is required for a specific loan (shown at the bottom of Figure 3). The ability to break up the envelope into multiple parts depending on requirements during the loan process workflow was an important consideration for loanDepot when choosing the Docusign API.

Figure 2: The loanDepot Customer Portal gives customers a one stop view.

Figure 3: loanDepot’s Customer Portal, with pre- and post-sign borrower views.

Innovation + Flexible API = Success

After implementing the eSignature component of the customer portal, loanDepot was able to process up to 12,000 transactions every day through the Docusign Signature API with only three weeks-worth of development effort. In addition, the borrower gets a great seamless experience while reducing loan closing times by as much as five days.

The customer portal was so successful that loanDepot’s Vendor Management and Accounts Payable departments integrated Docusign as the standard for signing invoices with vendors and contractors as well.

You can hear from Mark Hansen directly in this video. And you can try out the power and flexibility of the Docusign Signature API for yourself with a free sandbox and see for yourself why loanDepot chose the Docusign API.

Tony Mann has been with Docusign since 2016, helping developers integrate Docusign into their apps. He is a published author and an expert SQL developer with a passion for developer education.

Related posts

Docusign IAM is the agreement platform your business needs