Improving Small Business Loan Applications with Docusign

Digital infrastructure can connect the processes and documents involved in small business loan processing, for faster and more efficient submissions.

Across the United States, a series of shelter-in-place orders and social distancing practices have made small businesses incredibly vulnerable. With such a sudden drop in foot traffic and forced closures for nonessential services, it’s becoming difficult for these businesses to pay their bills and continue operating. To help small businesses through the uncertainty, the United States signed the Coronavirus Aid, Relief and Economic Stimulus (CARES) Act, which includes $350 billion in loans for small and medium businesses.

In line with this new stimulus package, a single business can secure as much as $2 million, but the amount of each loan will be evaluated based on an assessment of each business’s actual economic impact. According to the U.S. Small Business Administration (SBA), the interest rates on those loans will not exceed 4% per year and the terms will not exceed 30 years.

The importance of processing SBA loans quickly

There are 30 million small businesses that need access to the resources made available in the CARES Act and they’ll all be moving fast to stay operational. Half of these small businesses don’t have enough cash on hand to cover costs for even one month without new revenue. Getting the approved loan funds into the hands of these business owners is a race against the clock.

As a lender to small businesses, it’s imperative to process as many requests as possible and to move as fast as possible. The unpredictable business landscape and the availability of funds ensures that the loan process will be extremely competitive, so it’s imperative to be an early mover in the filing process.

The SBA has a long list of documents on its loan application checklist, however the standard process usually involves more than just gathering documents—there are also application capture and ID verification processes, which are typically handled in person at a branch. Under the current conditions, lenders that digitize the steps necessary to create a remote loan processing workflow will have an enormous advantage in terms of getting CARES Act loans approved and getting crucial funds into the hands of the business owners who need that cash so badly.

Streamlined SBA loan processing

The SBA loan process is complex, with a series of highly manual steps in the standard agreement process. Docusign can help lenders upgrade their process at various steps by replacing outdated workflows with a more automated and efficient process. By implementing a modern system of agreement, lenders can reduce, if not avoid, paper-based processes that require manual resources to process and complete, eliminate bottlenecks that can delay agreements, reduce errors that accompany manual data entry and ensure compliance with security standards.

This improved digital infrastructure can connect the tools, processes and documents involved in loan processing, resulting in faster, more accurate and more efficient submissions. It helps small businesses improve their chance of qualifying for a loan and minimizes the frustration of bank employees who manage the loan process.

Below are a few ways that Docusign’s digital system of agreement can help banks improve SBA loan submissions at each step of the document lifecycle:

Prepare: Automate the creation of digital forms, prefilling relevant information based on integrations with other systems.

Sign: Implement Docusign eSignature to make it simpler and more secure for anyone to complete and sign SBA loan applications or any other necessary forms.

Act: Automate steps in the loan submission process to complete faster, decrease administrative mistakes and cut back on staff time required to manually process/fill forms.

Manage: Store completed forms in the cloud for easy searchability and access, reducing the cost and hassle associated with paper form management.

How Docusign can help

Docusign offers a suite of products that can help a lender speed up SBA loan submissions. Our eSignature, ID Verification and Contract Lifecycle Management products provide the tools to help small business lenders quickly upgrade their infrastructure, allowing them to complete loan paperwork faster and easier.

Here’s more information about how each product can improve your workflow.

eSignature: Processes that involve filling out paperwork may be able to benefit from the most modern means of signing agreements. Our highly rated mobile apps for iOS, Android, and Windows empowers a borrower to sign an agreement from almost anywhere at any time. Docusign eSignature allows a lender to add standard fields to agreement forms, including signatures, dates and custom fields that are required. With more than 350 prebuilt integrations and open APIs, Docusign can easily connect with the systems and tools you already use, like Salesforce or nCino.

ID Verification: At several stages of the SBA loan process, it becomes important for borrowers to verify their identity. Identifying borrowers quickly and efficiently can reduce cost and risk, helping protect lenders from fraud and keeping them in compliance with regulations like Know Your Customer. Docusign provides a lender an additional tool to help verify a borrower’s identity using a variety of options, including a government-issued ID, SMS, phone, access code and knowledge-based authentication.

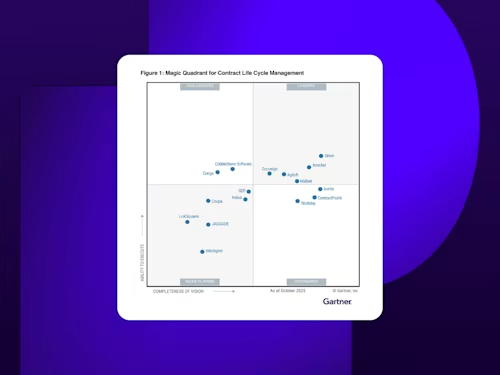

Contract Lifecycle Management: SBA loans involve more than just collecting and signing the right documents. Those documents need to be prepared, signed and submitted in the right order and then acted on correctly to ensure a loan gets approved. Manually moving each document through this series of steps is an easy way to run into roadblocks or bottlenecks in the submission process. Building a technology stack with a series of point solutions for individual steps is inefficient, costly and introduces more room for breakdowns. Docusign CLM can manage the end-to-end process in a more seamless solution, utilizing workflow automation to cut down manual work and redundant data entry.

The entire Docusign suite of products ensures that any lender can streamline the SBA loan submission process while maintaining compliance at every step. Docusign meets some of the most stringent U.S., EU and global security standards while offering strong data encryption technologies. On top of that, Docusign has invested in maintaining certifications in the most robust regulatory and industry standards including SOC1, SOC2 and PCI compliance.

If you want to learn more about how Docusign can help your business streamline applications for SBA loans in conjunction with the CARES Act, all you have to do is contact us. Our experts will walk you through our product and have a discussion about your particular system of agreement. We even offer a 30-day free trial if you want to see how it works with your business’s workflow.

Docusign customers: Log into the Knowledge Market check out our SBA Loan resources page to help your business deploy SBA lending solutions.

Related posts

Docusign IAM is the agreement platform your business needs