How Docusign and Microsoft Streamline Quote-to-Cash Workflows

Inefficient Quote to Cash processes can cost B2B organizations more than 20% of their contract revenue. Docusign’s integrations for Microsoft are here to help.

- What’s wrong with today’s Quote-to-Cash process?

- Who is impacted by inefficient Q2C processes, and how?

- The #1 key to streamlining your Q2C process

- What other tools integrate with Docusign to accelerate your Q2C process?

- What Sales Ops and Finance can expect from an optimized Q2C process

- Beyond Finance and Sales Ops: Other departments that benefit from streamlining Q2C

- Conclusion

Table of contents

- What’s wrong with today’s Quote-to-Cash process?

- Who is impacted by inefficient Q2C processes, and how?

- The #1 key to streamlining your Q2C process

- What other tools integrate with Docusign to accelerate your Q2C process?

- What Sales Ops and Finance can expect from an optimized Q2C process

- Beyond Finance and Sales Ops: Other departments that benefit from streamlining Q2C

- Conclusion

The complexity of modern B2B sales can make the Quote to Cash (Q2C) process painful, slow, and inefficient. This isn’t just frustrating - it’s a major obstacle to revenue and growth.

According to recent research from Deloitte and Docusign, inefficiencies in the average B2B organization’s Quote to Cash process and the “Agreement Trap” it produces are among the top culprits of profit leakage these organizations face. Their research finds that, on average, companies spend an extra 18% of time on agreements and miss out on $1.5M in revenue. This equates to 55 billion wasted hours and a $2 trillion global economic loss every year.

There’s a solution to this problem: streamlining and accelerating your quote-to-cash business process with Docusign’s integrations for Microsoft. Our integrations can help you:

Spend less time on paperwork and more time with customers

Boost confidence in outcomes by providing consistency and accuracy

Smooth handoffs with the help of automation and a single secure, central source of data

Lay the groundwork to nurture thriving customer relationships

In this blog, we’ll cover everything you need to know about how your quote-to-cash process may be holding you back and how Docusign’s integrations for Microsoft are prepared to help.

What’s wrong with today’s Quote-to-Cash process?

Contemporary B2B organizations are selling complex products with equally complex pricing structures. They work with buyers to coordinate customized discounts based on dozens or even hundreds of unique factors.

Organizing these factors requires managing MSA, NDA, SOW, purchase orders, and potentially hundreds of other agreements and contracts. Getting these contracts into the right hands at the right time usually means repeatedly sending them to different stakeholders in multiple departments using proprietary systems. The result is a slow, manual, and disjointed sales process that doesn’t work for anyone—not to mention added compliance and audit risks.

Despite all this (preventable!) loss, however, most organizations haven’t changed much in how they manage their Q2C agreement process in the last 100 years or so.

This is the crux of the problem. It’s not necessarily that Q2C has become too complex; it’s that many organizations are still managing it as if it isn’t complex at all.

Who is impacted by inefficient Q2C processes, and how?

In short, nearly every part of your organization is negatively impacted by a broken Q2C process - not to mention your customers themselves. Let’s break it down department by department:

Sales: A broken Q2C can lead sales teams to miss renewals, undervalue the contracts they sell, frustrate their customers, and miss their sales targets.

Sales Operations: Without the full picture provided by a streamlined Q2C, sales ops teams may price products suboptimally, forecast inaccurately, and allocate resources improperly.

Finance, Procurement, and Revenue Ops: When deals get lost in Q2C issues, your finance team might experience billing challenges that result in poor cash flow, inaccurate reporting, audit issues, and customer disputes.

Legal: An inefficient Q2C puts a significant burden on your legal team, who will have an increased workload resolving the issues it produces. It also increases your organization’s compliance risk exposure.

Fulfillment: A broken Q2C commonly results in inaccurate orders or service delivery. This can harm your relationship with your customers and result in additional remediation costs.

Customers: Your outdated Q2C can result in a disjointed, frustrating experience for your customers, causing them to lose confidence in you and making it less likely that they continue to use your services.

"DocuSign integrations for Microsoft boost consistency across agreements and reduce risk, and we get work done faster - which directly translates into reduced time to revenue."

- Matthew Cass, SVP and Executive Director for Operational Excellence at Consor

The #1 key to streamlining your Q2C process

The key to streamlining your Q2C process is integrating the systems involved in the Q2C process.

Docusign and Microsoft have been strategic partners for over a decade, and our systems and applications are designed to integrate effortlessly. With Docusign integrations for Microsoft, your team can prepare, sign, collaborate, store and manage agreements related to the quote-to-cash process without leaving the Microsoft apps you already use every day.

Our integrations encompass a wide range of Microsoft products including Outlook, Teams, Copilot, Sharepoint, Dynamics, and Power Automate, to help you achieve a streamlined Q2C process.

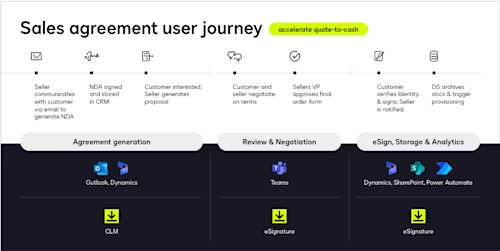

This quote to cash process flow chart illustrates how your Q2C could happen with Docusign integrations for Microsoft, step by step:

What other tools integrate with Docusign to accelerate your Q2C process?

So far we’ve discussed how Docusign’s integrations for Microsoft are designed to streamline the Q2C process. But Docusign integrates with MORE than just Microsoft. Docusign integrates with systems across your entire Q2C process, including:

Nearly every ERP, including SAP, Oracle, etc.

CPS software, including Salesforce, Conga, and more

Procurement Systems including Coupa and SAP Ariba

CRM systems including SAP, Oracle, Dynamics, Salesforce, and more

What Sales Ops and Finance can expect from an optimized Q2C process

Accelerating your Q2C process will relieve several big pain points for your Finance and Sales Operations teams.

Your sales ops can expect:

Streamlined contract generation, collaboration, review, and execution

A way to execute each process in systems sellers are already familiar with

Synthesized agreement data they can use to drive better outcomes

Renewal alerts and the ability to search through T&Cs quickly

A centralized source of contract data

Meanwhile, your finance team can expect:

A seamless way to connect contracting processes

Full visibility into contract progress, details, fulfillment, and obligations

Pre-approved templates and clause libraries

Standardized ERP mapping for fast categorization and collectibility

Contract analytics insights

Beyond Finance and Sales Ops: Other departments that benefit from streamlining Q2C

The benefits of streamlining your Q2C process are massive and far-reaching. They include:

Minimizing or avoiding errors and improving the visibility of agreements: Confirm and close deals much faster and alleviate the burden of repeatedly chasing down agreements to verify accuracy.

Who this helps: Finance including Procurement, Sales Ops, and Sales

Closing deals faster and increasing seller productivity: Reduce agreement turnaround time to hours or even minutes with automated workflows. These automated workflows helped Salesforce make 85% of their sales agreements “no touch.”

Who this helps: Finance, Sales Ops, and Sales

Maximizing deal value: Boosting confidence and outcomes and reducing the number of sales getting delayed or canceled will raise the value of each deal and expedite time to revenue significantly. Implementing Docusign+Microsoft helped one Electronics Manufacturer generate $5 million in additional revenue each year.

Who this helps: Finance, Sales Ops, and Sales

Securely speeding up business: Keep documents moving forward with the help of notifications your team will receive directly in apps like Microsoft Teams. These notifications helped Flowserve speed up its legal reviews by 40 percent.

Who this helps: Finance including Procurement, Sales Ops, and Sales

“We used to support about 100 agreement reviews a quarter with our old approach. Just halfway into the year, we’ve already hit the 600-mark using Docusign and we haven’t added any legal team capacity.” - Sarah Smart, CRO, Calendly

Improving emails and meetings: Instantly improve emails with vital details from your agreement library with the help of the AI-enabled Microsoft Copilot for Sales

Who this helps: Sales, Sales Ops

Ensuring compliance: Ensure full visibility into every stage of the agreement with a robust audit trail that complies with global security standards.

Who this helps: Legal, Finance including Procurement, Sales Ops

Creating better experiences and preserving account health: Eliminate the need to toggle back and forth between systems by signing or requesting signatures from within the Microsoft apps you’re already working with. Integrations like these helped Refinitiv improve its positive sales experiences by 20 percent.

Who this helps: Sales, Customers

Making the most of your existing Microsoft investments: Get even more out of your Microsoft products and leverage your MACC agreement to acquire and benefit from new integrations. Purchasing through MACC can facilitate easier budget allocation, while also simplifying procurement—as Microsoft is likely already an onboarded vendor within your company’s operations.

Who this helps: IT

Conclusion

When you’re ready to reclaim the $1.5M revenue your contracting inefficiencies and Q2C process are letting slip through your fingers, use your MACC agreement to fund the purchase of Docusign via Microsoft’s Azure Marketplace. It’s just that easy.

Beyond Q2C—Docusign’s integrations for Microsoft can bring even more value to your company:

Streamline customer, vendor, and partner onboarding

Simplify HR recruiting and employee onboarding and offboarding

Speed up legal agreements like MSAs, NDAs, and internal form fills

Related posts

Docusign IAM is the agreement platform your business needs