How Banks Turn Modern Agreement Processes into Customer Satisfaction

To quantify the effects of improved agreement processes, Docusign conducted a survey of current banking customers.

At the heart of all banking processes—especially customer-facing interactions—are agreements. Modern banks are adopting Docusign eSignature as an easy first step into agreements that are more automated and simpler to complete.

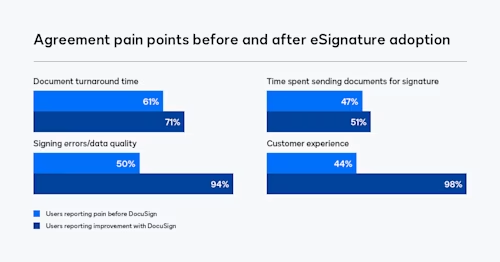

To quantify the effects of improved agreement processes, Docusign conducted a survey of current banking customers. Respondents were asked a series of questions about their experiences before and after implementing eSignature. The technology drastically improved the most common problems areas. The result was faster turnaround (by an average of 50%), less time spent on documents (by 30%), better customer experience and less risk of errors.

Today’s banks are leveraging multiple eSignature capabilities to streamline common bottlenecks in the agreement process. For example, reusable templates eliminate repetition and standardize common agreements like account opening applications, PowerForms enable self-service capabilities for common customer requests and bulk send distributes documents, like internal HR policies, to multiple recipients.

They’re also adding integrations to common systems like CRMs, document management technology, loan origination software and ERP tools. All of these systems—and a lot more— can be seamlessly connected to the signature process using APIs and prebuilt integrations.

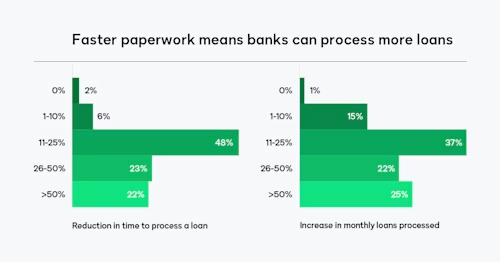

The early return on these technology investments is positive. The average Docusign customer in the banking industry is reducing loan processing time by 31%, which means more loans can be processed.

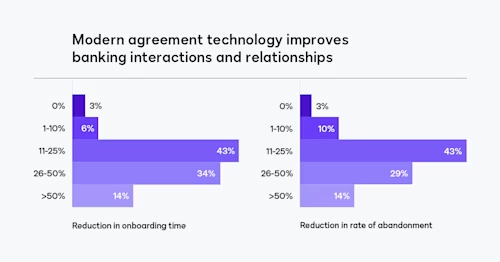

They are also seeing improvements in their account opening and new customer onboarding processes, with a 30% reduction in abandonment rates on average. As new generations of digitally savvy customers start taking out loans, they’ll bring high expectations for mobile-friendly on app-based experiences. This generation will demand smooth document processes to ensure they don't abandon new customer paperwork.

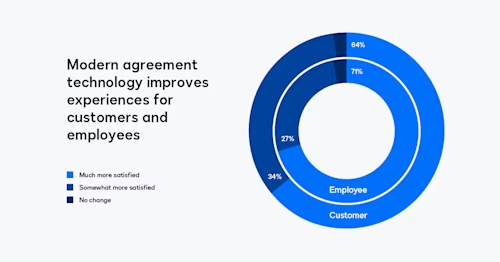

In addition to the new business, banks are also reporting near-unanimous improvements in employee and customer satisfaction. While those metrics don’t directly contribute to revenue, they are tied to a series of actions that positively impact the bottom line.

As impactful as it is, eSignature alone isn’t the end of the digital transformation, it’s only the first step. Throughout the lifecycle of a banking document, there are several opportunities to include additional features and integrations to simplify the process and create new business value.

For banks interested in taking the next step in the digital transformation of their agreement process, here are a few suggestions:

SMS Delivery + responsive signing: enhance the mobile experience by delivering easily readable agreements and allowing signers to take action

ID Verification: verify signer identity instantly using government-issued IDs

Advanced workflows: Automatically send agreements to the right parties at the right time with advanced recipient routing

UFCU works with hundreds of vendors, but Docusign is one of our longest relationships. That speaks volumes of the product and the partnership we have.

Kaylyn LeeseManager of Lending Systems, University Federal Credit Union

*The data for this research was collected by Paradoxes (commissioned by Docusign) in the summer of 2021. A survey of about 60 questions was completed by 440 respondents in the U.S. and Canada. Participants included a blend of senior roles (primarily in finance departments) from organizations that specialize in banking, lending, insurance and wealth management.

Related posts

Docusign IAM is the agreement platform your business needs