Faster Insurance Agreements Mean More Customers and More Satisfaction

One of the biggest benefits of a more powerful system of agreement is more efficient processes to open new policies and process claims for customers.

The insurance industry is full of important customer-facing documents: quotes, policy applications, claims paperwork and a lot more. Each touchpoint an insurance agency or carrier has with a customer presents an opportunity to create value with faster, easier and more customer-friendly operations.

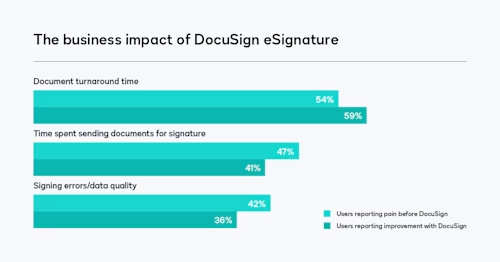

To understand how today’s insurance companies are using agreement technology to increase revenue, Docusign conducted a survey of current customers. Respondents were asked a series of questions about their experiences before and after implementing eSignature. The result is faster turnaround time and enhanced experiences across the board.

The degree of improvement on these metrics is also significant. The average user was improving document turnaround time by 40% and reducing the time spent sending documents by 31%. Most dramatically, 93% of insurance firms reported that data quality was either “somewhat” or “significantly” better with Docusign.

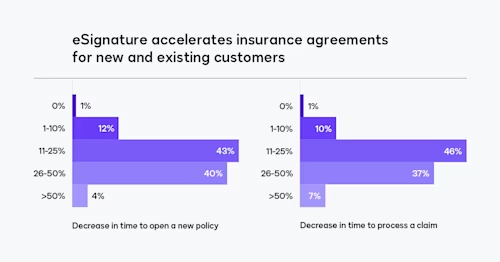

One of the big benefits of a more powerful system of agreement is more efficient processes to open new policies and process claims for customers. eSignature is reducing the time to do both by an average of 27%.

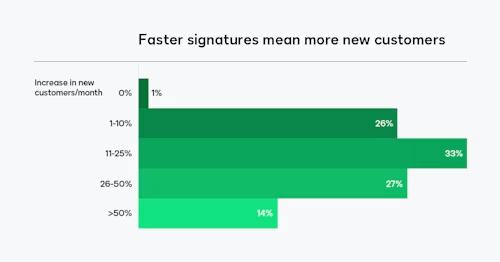

It’s easy to see how faster policy opening processes can lead to additional customers, and the data backs that up.

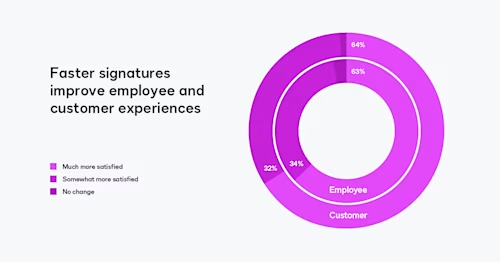

Faster agreements throughout the business also translate to near-unanimous satisfaction gains with both employees and customers. With more new customers, faster claims processing and high satisfaction scores, it’s easy to see how a better system of agreement can lead to business gains for insurers.

As impactful as it is, eSignature alone isn’t the end of the digital transformation, it’s only the first step. Insurance organizations have several more opportunities throughout the agreement lifecycle to simplify work and create new business value.

Insurance carriers and agencies can meet their customers in their preferred channel by creating mobile-friendly signing experiences. You can deliver agreements to mobile devices using SMS Delivery and improve readability with responsive signing and smart sections. Even authenticate customers easily with a suite of identification options.

Simplify life for agents and employees by integrating Docusign with core systems like Guidewire or agency management systems like Vertafore or Applied Epic. Improve their efficiency by simplifying workflows with supplemental documents or signing groups.

When COVID hit and we closed our doors, Docusign saved our lives. If it weren’t for the ability to get an electronic signature, we wouldn’t have written half the new business we did last year.

Stacy JohansenPresident, Downeast Insurance

*The data for this research was collected by Paradoxes (commissioned by Docusign) in the summer of 2021. A survey of about 60 questions was completed by 440 respondents in the U.S. and Canada. Participants included a blend of senior roles (primarily in finance departments) from organizations that specialize in banking, lending, insurance and wealth management.

Related posts

The Checklist Every New General Counsel Needs

Discover what's new with Docusign IAM or start with eSignature for free