Accelerate the claims process and delight your customers

By Steve Krause, Senior Vice President, Strategy and Product Marketing, Docusign

We’ve all become accustomed to one-click shopping, one-click ridesharing and one-click home buying. Companies like Amazon, Uber and Rocket Mortgage are rewriting the rules on speed and ease of business transactions.

It is no surprise that customers are expecting the same level of service and convenience in all aspects of their lives. Even though nobody is looking forward to filing a claim, a painful and lengthy claims process makes matters worse. As an insurer you have to delicately balance processing claims efficiently while also delivering an experience worthy of retaining your customer.

Claims experience is tied to customer satisfaction.

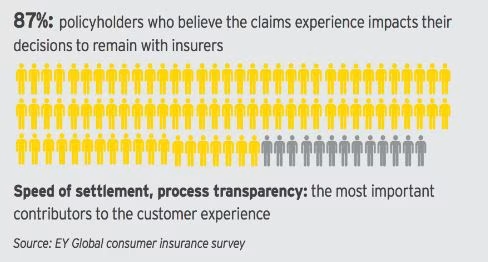

According to E&Y, “When the claims process breaks down, consumer satisfaction falls and insurer costs go up—that is the penalty effect of a bad claims experience. In this sense, every claim is a ‘moment of truth.’”

Filing a claim can be a very stressful and trying time for the filer—be it loss of life or home. Having an insured work through filing paperwork, proving identity or simply re-sharing basic information can aggravate filers. At a time of crisis, your customers expect empathy and convenience.

Automation can drive productivity as well as deliver higher customer satisfaction.

Paper-based contracts and claims can be slow, expensive and highly manual processes that bring challenges of data errors due to incomplete or inaccurate information capture. The bigger risk paper poses is that it opens doors to fraud and non-compliance.

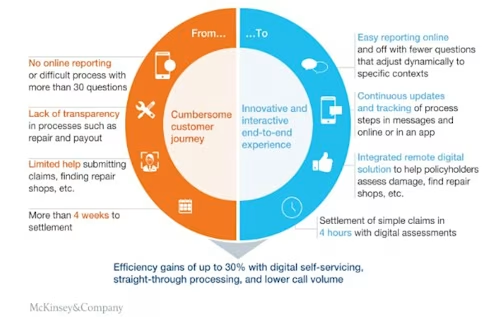

The results for those organizations that do take steps in the direction of implementing automation are very rewarding. According to McKinsey, US auto insurance carriers that have provided customers with consistently best-in-class experiences have generated two to four times more growth in new business and about 30 percent higher profitability than firms with an inconsistent customer focus, in part because satisfied customers are 80 percent more likely to renew their policies than unsatisfied customers.

Source: The growth engine: Superior customer experience in insurance | Article

Considerations for a successful digital transformation.

Claims digitization and automation should not be an all-or-nothing approach. Take incremental steps towards automating one step of the claims journey at a time. Identify the most critical areas for your customer, build a proof of concept, test out the impact, then consider deploying a similar experience broadly.

Step 1: Upgrade legacy claims forms and change of beneficiary forms to a Guided Forms Experience on your portal that is intuitive and easy to follow.

Step 2: Determine how customer consent is being captured on key steps of the claims process. Are customers having to walk into an office to identify themselves or sign documents? If so, enable them to identify digitally from their mobile device anytime.

Step 3: Identify how your claims agreements and packets are being prepared today. If your employees are manually preparing agreements using data you already have in other systems, integrate with those systems, such as Guidewire, to automate agreement preparation. The result will speed up processing, eliminate errors from manual re-entry, and allow employees to spend more time helping customers and less time on paperwork.

Step 4: Assess how claims Payments will be processed. High volume but low value claims can be digitally reimbursed, saving carriers and agents time and driving efficiency.

Step 5: Determine how your organization will keep up with compliance requirements. Ensuring you have digital audit trails will save the pain of scrambling to ensure key declarations, terms & conditions communications were met throughout the claims process.

Docusign Agreement Cloud: Digitize every agreement and speed up claims.

The Docusign Agreement Cloud helps agencies, agents and insurers accelerate claims while staying compliant. One of the largest insurers, AIG, struggled with legacy paper-based forms, manual approvals and workflows. “Every new paper form that’s introduced adds cost and complexity to our process,” explains Eric Eisenman, Global Head Of Customer Claims Operations. “Docusign is helping us change that by moving to a digital process that relies on digital forms, allowing us to accurately capture data in a secure way. “Docusign,” he adds, “is also helping us reduce our risk with automated signature authentication, so we know that a document has been sent to the right person and we’re not exposing data to the wrong party. [The process] improves the customer experience, takes costs out and makes employees lives easier, so [they’re] able to service customers better and solve problems faster.”

Learn more about what Agreement Cloud means here.

Related posts

Discover what's new with Docusign IAM or start with eSignature for free