Shaping the future of banking and financial services in Hong Kong: A DocuSign primer for developers, Part 1

In this series of blog articles, we explore how Docusign delivers — specifically, for a common use case in the banking and financial services sector.

By Charlie Loo, Principal Solution Consultant, Docusign

Developers who build banking applications love to work with platforms that are fast to set up, easy to use and have clear documentation to help accelerate development cycles and meet deadlines. In this series of blog articles, I’ll show you how Docusign delivers — specifically, for a common use case in the banking and financial services sector. This is the first of three blogs.

Across Asia, the banking and financial services sector is working hard to digitally transform. The overarching goal? To create more streamlined and efficient banking systems — ultimately enabling greater expansion throughout the region and enhancing the customer experience.

To get there, banks need to connect and integrate all the different applications across the banking ecosystem. And the people tasked with delivering on this goal? Developers.

More than ever, developers in the banking and financial services sector are being tasked with bringing new banking services and apps to market. The pressure’s on to deliver these apps quickly and securely, with minimal risk, in an increasingly complex environment that encompasses “rapid advancements in technology, such as AI and blockchain, and the drastic changes in the macro environment, including post-pandemic challenges, weakening global growth, and an uncertain trajectory of inflation.”

The scene for this rapid digitalisation of banking services was set long ago. In Hong Kong, for example, the Open API Framework was introduced in 2018 by the Hong Kong Monetary Authority (HKMA) to give API developers unprecedented access to a wide range of banking data. This data was previously inaccessible, and it opened the door for developers to innovate, collaborate and create more secure and user-friendly financial services.

In the years since, banks and financial institutions have been exploring how digital transformation can help boost productivity, enhance operations, and reduce the overall cost of serving customers. A key focus area? Agreements. After all, they are everywhere across the banking value chain — from account openings to loan applications and account servicing.

Today, I want to focus on one of these agreements, account opening, and explore how developers can use Docusign to better enable both process automation and self-service — ultimately delivering a more streamlined experience for customers.

Opening a bank account

Every day, in banks and financial services institutions around the world, new accounts are opened. What if this process could become faster and easier, both for banking employees and customers? What if you could eliminate the need for customers to queue up in banks to supply personal information and prove their identity?

Imagine how much time could be saved, and how much better the customer experience could be.

Let’s explore how developers can embed Docusign eSignature into the account opening process within Internet Banking to achieve exactly this. By digitising the process, customers wouldn’t have to visit the branch — instead, they could complete the account opening application at the comfort and convenience of their home.

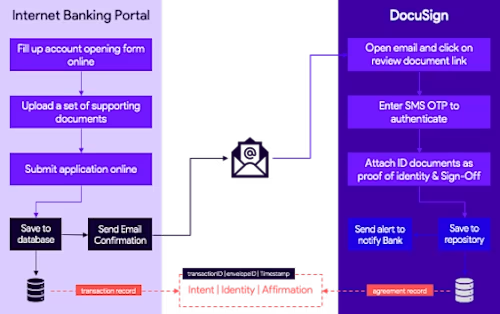

As the diagram below shows, the Docusign part of the journey essentially replaces the step where a customer has to queue up in the bank to submit their form and prove their identity. Behind the scenes, the workflow is automated and seamless, saving bank employees valuable time, too.

Developer Blog Image 1

Let’s break down the key steps involved in setting this up.

1. Start with the eSignature API

You can use the award-winning Docusign eSignature API to integrate the full functionality of eSignature — including electronic signatures, form automation and document tracking — into the application you use to facilitate account openings.

2. Authenticate

A crucial step in the process is authentication. Essentially, before your application can start making calls to the Docusign eSignature API, it must authenticate and be granted an access token. This access token, which proves your app’s identity and authorisation, must be included in every request made to the Docusign eSignature API.

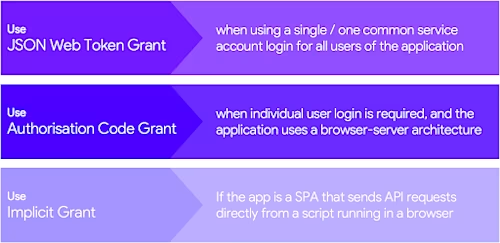

At Docusign, we use OAuth 2.0 to secure your API requests. You’ve got three simple options for implementing OAuth in your application: JSON Web Token (JWT) Grant, Authorisation Code Grant, or Implicit Grant.

Developer Blog Image 2

Banking applications that are deployed to support end-to-end business workflows and self-service automation are typically integrated with Docusign via a service integration. Service integrations are often heavily automated and will frequently call the Docusign platform without requiring direct human intervention. Developers, in such scenarios, generally opt for JWT Grant as the OAuth 2.0 flow.

3. Request signatures by email

Say you’ve got a new-to-bank (NTB) customer who doesn’t have access to Internet Banking yet. The easiest way to sign them up is by sending the agreement via email. The email will contain a signing link that the customer can use to open and electronically sign the agreement on the Docusign mobile app or website.

All the steps in setting up signature requests via email are laid out here.

Now, you’re ready to deliver a more streamlined experience

Once this streamlined account opening workflow is set up, you’re on your way to a much better customer experience that enables greater self-service and automation of key steps in the journey.

Watch out for the next article in this series, where I will dive into identity verification — a crucial next step in the journey towards end-to-end digitisation of agreement processes like bank account openings.

Discover what's new with Docusign IAM or start with eSignature for free