Who are you doing business with? The future digital ID verification

How can you know who you’re doing business with online? A robust and scalable online identity verification system is the right solution !

How can you know who you’re doing business with online? From house purchases to dating apps, booking international travel to signing a new employment contract, and from accessing healthcare to managing money - we are all conducting important life activities online with ever greater frequency.

The proliferation of online agreements underpins the continuous growth of the digital economy because they are the guarantees of trust that must underpin any business interaction. However, this demands a robust and scalable online identity verification system that can be recognised by businesses and governments alike.

That's where the partnership between Docusign and Checkout.com comes into play. Docusign’s mission is to enable organisations to create, commit to and manage their agreements across the entire agreement lifecycle. As part of this, it seeks to power and streamline every type of agreement process anywhere around the world while delivering the highest level of trust with the lowest level of friction in the flow possible. Docusign’s commitment to delivering its 1.5 million plus global customers a digital identity verification (IDV) solution that fosters trust through reliability and usability is what led them to partner with Checkout.com and utilise their AI-powered Identity Verification solution.

In a timely discussion, hot on the heels of the EU pertinent eIDAS updates, Checkout.com and Docusign co-hosted a LinkedIn Live session on the exciting trajectory of digital identity verification. François Wyss, General Manager, ID Verification, Checkout.com and Maxime Hambersin Senior Director of Product Management International at Docusign spoke for 45 minutes on the topic. Here is a summary of their key points and reflections.

How where we came from is shaping where we are going

“Early forms of online ID verification progressed from static images to live video chat solutions - there were no industry standards for verification leaving plenty of scope for easy fraud” according to Checkout.com’s Francois Wyss. Today, as online fraud and deep fakes become ever more sophisticated and prevalent it has become near impossible for people to know who they are doing business with over the ether without more robust technology. Wyss reflected that in the past 5 years, the prevalence of deepfakes as the proportion of attempted fraud seen in ID verification has multiplied 15X. That’s why leading-edge, AI-powered solutions like Checkout.com’s Identity Verification, have come into the spotlight. They’re reshaping digital experiences for people and businesses globally and helping them interact, contract, and transact instantly. “The levels of trust introduced to the ecosystem by solutions such as IDV have clearly led to a surge in adoption,” says Dousign’s Maxime Hambersin. “There’s no doubt we have acquired many new users of online identity verification since introducing Identity Verification because cautious individuals, smaller businesses and so on…are feeling more trust in the process and want to benefit from it.”

The proliferation of digital identity verification use cases is driving a surge in demand for reusable verification methods. “Initially used primarily for onboarding purposes in various sectors such as services and employment, these verification systems are now being leveraged for a broader and broader array of use cases” reflects Hambersin “and with that scale, comes a new level of expectation for speed and convenience, as well as reliability.”

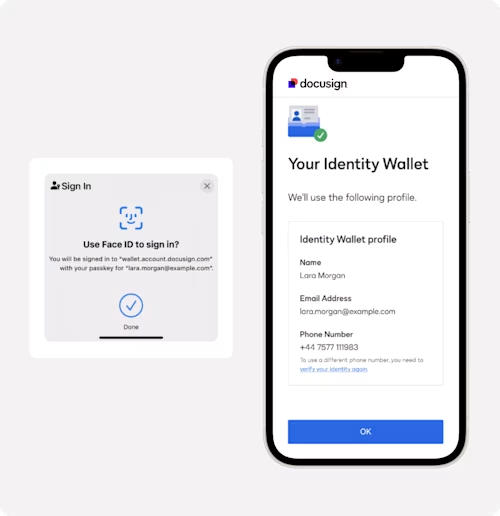

Just as online shoppers now expect not to have to retype all their card details each time they make a purchase, people are starting to expect a similar functionality for their identity verification. “Businesses have no interest in putting loyal customers through additional, repeated friction if they can avoid it” reflects Hambersin. Naturally, the quest to streamline subsequent verifications and avoid repetitive and cumbersome verification processes has fed the demand for some kind of reusable digital ID verification. This is where the notion of a digital Identity Wallet comes into the frame.

Digital ID Wallets: Trust at scale

A reusable digital Identity Wallet would be unique to each individual, encrypted to safely contain a single ID verification that can be reused limitlessly. This offers numerous benefits, primarily in streamlining verification processes and enhancing user experiences. Compared to traditional methods like video verification, which are time-consuming and costly, a reusable Identity Wallet significantly reduces the verification time to mere seconds, thereby enhancing efficiency and lowering operational expenses. Establishing trust within a remarkably short span—achieving extremely high conversion rates within seconds according to Hambersin—the adoption of such wallets facilitates seamless online transactions, aligning with the modern consumer's expectation for swift and user-friendly experiences.

Beyond expediency, reusable identity wallets promise heightened security, as they function as a securely encrypted digital repository of one's identity, eliminating the need for physical ID documents and minimising the risks associated with document theft or loss.

Docusign’s Hambersin adds that “while the current focus is on the need to strike a balance between trust and convenience in online verification, and that balance is always a little bit of ‘give and take’ depending on the nature of the agreement at stake, our conviction is firm that the effort to strike this balance will ultimately disappear and optimal convenience and trust will be delivered at once in a totally black and white way - like handing over your passport at border control. It will be that simple and that standardised.”

“There are so many conversations going on about the wallet use case within the ecosystem,” says Wyss, “for those of us who build the technology, we can see the huge opportunity that exists as far as ID wallets are concerned, but it's complicated, it's really like building another layer of infrastructure for the internet!”

eIDAS and the future of EU-wide ID Wallets

The eIDAS 2 EU legislation on digital Identity wallets represents a significant stride towards harmonising and fortifying digital identity mechanisms across the UK and European Union member states. With a focus on bolstering trust, interoperability, and security, this legislation aims to establish standardised protocols for the issuance and verification of digital identities.

By providing a framework for the secure sharing and authentication of digital identities, eIDAS 2 will help facilitate seamless and reliable online transactions while safeguarding user privacy and data integrity. This legislation not only streamlines the process of conducting business online but also sets a precedent for global standards in digital identity management.

Hambersin and Wyss both strongly welcome these moves by the EU which recognise and build towards the trajectory of the digital economy and the growing need for a robust cross-border digital identity framework. “This is a real opportunity for Europe to step in and define the next level of how we do business online,” says Hambersin “and we commend the fact that the EU is focused on an interoperability model, that’s going to be difficult but crucial”.

Bulletproof

The security and trustworthiness of digital identity wallets are paramount considerations, as emphasised by ongoing debates within the EU and industry regarding the creation of reusable digital IDs. The initial creation of a digital identity wallet necessitates meticulous attention to security measures, as this verification process forms the foundation for subsequent uses. The escalating threat of fraudulent activities, particularly with the proliferation of deepfakes, underscores the critical need for stringent security protocols. Hamersin makes the point that people demand extremely high standards of trust online: “Although society may tolerate a certain level of fraud in analog contexts, digital environments demand a higher standard of reliability, requiring verification processes to be virtually bulletproof.”

He goes on to explain that any compromise in the security of digital identity wallets poses significant risks, not only to individual users but also to brands and products across the digital economy. “The potential fallout from a compromised wallet extends far beyond its immediate users,” says Hambersin “with the collapse of trust jeopardising the integrity of all subsequent transactions and threatening the stability of the entire system.” Thus, ensuring the robustness and reliability of the initial digital ID verification processes for every single member state scheme is paramount to safeguarding trust and preserving the functionality of digital ecosystems.

Interoperability is key

And this directly relates to why Interoperability is going to be so fundamental. Each country needs to create wallets which bear equal standards of trust and reliability. “With varying levels of maturity in achieving initial ID verifications across member states, ensuring interoperability becomes imperative for seamless cross-border transactions,” says Wyss. And Hambersin adds that “while some countries, like Belgium and Nordic nations, have advanced digital ID infrastructures, others are still in the process of development.”

Think of it from the point of view of businesses that will be required to accept these digital identity wallets. Large enterprises operating across multiple EU countries, managing potentially 27 different digital identity wallets could face significant logistical and user experience challenges without seamless interoperability and parity of wallets. Potential disparities in reliability between different national ID schemes could lead to distorted user experiences and loss of competitive advantage for businesses.

Checkout.com’s Wyss gave the example of a French bank that would be obliged to accept the onboarding of Italian clients. “Theoretically, if the Italian ID verification scheme was less robust and reliable than, for example the French scheme, the bank may have to enforce additional verification processes for Italian customers,” says Wyss. This in turn would lead to differences in the quality of customer experience - the Italians would suddenly have a worse experience than the French - leading to competitive disadvantages for the bank.

Make it inclusive and secure

The EU's regulations are laudable for the fact that they will foster a more inclusive digital ecosystem by mandating that each member state must provide a scheme for online identification, agree Wyss and Hambersin. However, the challenge will be to make the identity wallet “truly reliable and a pleasure to use” says Hambersin. Without that, adoption will likely be weak. And a key part of this UX must be about equality and inclusion. Addressing issues of gender, diversity, and racial bias that can occur in facial recognition technology will be crucial for creating an inclusive digital identity framework. Maxime highlights the importance of accessibility, asserting that any ID verification solution must be inclusive and not exclude any segment of the population. With the EU prioritising digital identity for business transactions, it is imperative that these solutions accommodate all citizens, regardless of demographic factors: “It's not enough to say ‘Great it works for 95% of the population’ when 5% are then locked out of the digital ecosystem.”

Ensuring data protection and inclusivity are equally paramount in the development of citizen digital identity wallets. “Rightly, people demand control over their sensitive information,” says Hambersin emphasising the importance of privacy and ownership rights. “Citizens will only adopt the wallets if they are utterly certain that their data is secure,” Wyss adds that of course this data protection links directly back to the issue of fraud and ensures that wallets don't become a source of information to help fraudsters capitalise on the system.

Thoughts for the future

“Ultimately it's not for the private sector to tell states how to manage the identity of their citizens” reflects Hambersin. “Our job is to support and facilitate this great initiative and at Docusign we are committed to creating solutions which work in tandem with the EU initiative and really help drive up adoption.” Wyss agrees that “as brands who are committed to empowering businesses and communities in the digital economy and to foster a thriving online ecosystem, Checkout.com and Docusign will be building products of the future which create a platform for the successful roll-out and adoption of digital identity Wallets.” There is a lot to get right but the momentum is strong” agree Wyss and Hambersin, the next important focus will be on how the rest of the world responds so that the digital ecosystem can be truly global and interoperable.

Related posts

Docusign IAM is the agreement platform your business needs