How to simplify remote ID verification

There are multiple reasons to verify ID, and as sensitive transactions move online, Remote ID verification is critical.

Table of contents

How to simplify remote ID verification

Remote identity verification becomes more critical and challenging as sensitive transactions move online. Identifying your signers helps you protect against fraud and comply with regulations. In some regions, a digital agreement is not legally enforceable without being tied to a strong identification process.

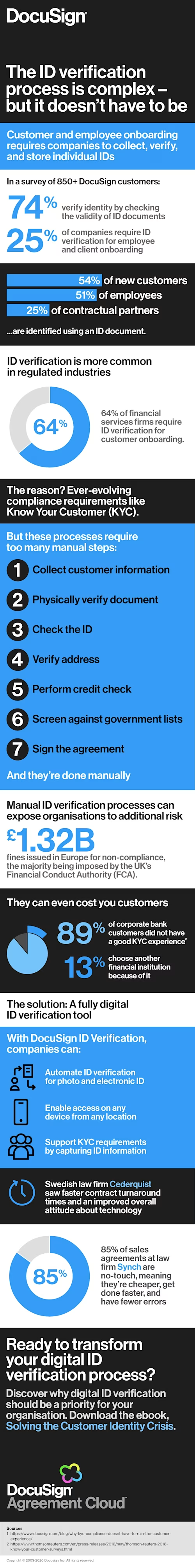

In regulated industries, like banking, the need for ID verification is more common. This is due to compliance with regulations like Know Your Customer (KYC). There are multiple reasons to verify ID, including customer and employee onboarding which requires companies to collect, verify and store individual IDs.

What are the problems with manual ID verification and checking?

Know Your Customer is critical to assessing customer risk, and it’s a legal requirement to comply with Anti-Money Laundering (AML) laws. Using manual ID checking can cause problems when trying to adhere to regulations like these and expose organisations to risk. The manual ID checking process involves many steps, including physically verifying ID, running credit checks, and screening against government lists.

There were £1.32 billion fines issued in Europe to financial organisations for non-compliance with the majority being issued by the UK’s Financial Services Authority**.** The manual process can also be a negative experience for customers. Customers can find it an inconvenience to take manual documents in-person to a branch and wait while their data is collected. They are increasingly accustomed to the on-demand convenience provided by digital-first companies like Uber and Amazon. It can slow or delay important processes like opening a new bank account, or a new insurance policy.

In a Docusign survey, 89% of corporate bank customers said they did not have a good KYC verification experience, and a further 19% went on to change their financial institution because of it.

How can companies simplify remote ID verification?

For many organisations, the ability to accurately execute online ID verification in a timely manner is essential for business to function, allowing them to make contractual agreements, comply with regulations, and deliver services to customers. Automated ID verification is essential for business growth. It provides better experiences and is a compliant process.

Digitisation of the process drives significant efficiencies as manual processes are causing negative experiences and increased risk.

So how can companies approach remote identity verification? Fortunately, there is a solution, a fully digital ID verification platform that allows you to automate ID verification for photo and electronic ID.

Transforming your digital ID verification process

Digitising the identification process reduces risk, increases trust and supports legal validity and compliance. A signer can verify their identity quickly and easily with a passport, drivers’ licence, or national identity card. The user can simply upload their ID from their computer or use a mobile device to take a photo of their documents. What’s more using remote identity verification ensures agreements are legally enforceable and compliant with preferred regional identification processes.

Docusign ID Verification

Docusign ID Verification automatically verifies a signer’s government-issued IDs and European eIDs on practically any device anywhere. The Docusign Identity Platform is a plug and play platform that helps you connect your preferred identification method into the agreement process. It can help companies to reduce agreements risks for important agreements across the globe.

There are several ways to use it; it works seamlessly with Docusign eSignature and achieves eIDAS compliance at the advanced signature level. You can also integrate the Docusign Identity Platform into your existing verification method or use the ecosystem of partners. ID Verification is the first Docusign product built on the Identify Platform.

For many organisations, the ability to accurately verify ID in a timely manner is essential for business to function, allowing them to make contractual agreements, comply with regulations, and deliver services to customers.

Read the infographic below to find out more about ID verification and the benefits of simplification.

Ready to transform your digital ID verification process? Download the eBook Solving the Customer Identity Crisis.

Our ID Verification infographic shows you how complex processes can be simplified.

Watch the on-demand webinar: Authenticate signers’ ID digitally for faster and more secure agreements or contact our sales team.

Related posts

Docusign IAM is the agreement platform your business needs