Liveness Detection for ID Verification

Do you want to switch to our US site?

An overview of how Docusign’s latest enhancement to its ID Verification offering can now better support FINTRAC compliance in Canada.

In today's increasingly online business landscape, organizations across the globe face the daunting task of finding the correct balance between delivering an efficient digital experience, maintaining a consistent level of security and integrity to safeguard sensitive data, and complying with industry regulations. In fact, 66% of businesses worry that customer experience and identity fraud prevention are competing priorities*.

Furthermore, industry regulations continue to evolve to ensure that businesses comply with regulations driven to prevent money laundering, terrorist financing, and identity fraud.

Among these, FINTRAC, the Financial Transactions and Reports Analysis Centre of Canada, plays a pivotal role in overseeing the conduct of financial institutions and other businesses subject to the Proceeds of Crime (Money Laundering) and Terrorist Financing Act and associated Regulations.

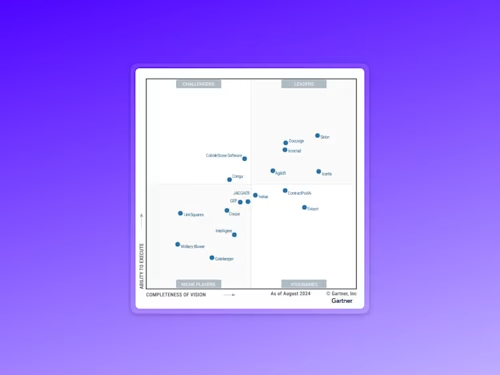

A registered member of the Digital ID & Authentication Council of Canada (DIACC), Docusign recognizes the challenges Canadian businesses face in navigating the complexities of the regulations FINTRAC oversees. Therefore, we are pleased to introduce an enhancement to our ID Verification offering, through the introduction of a dedicated ‘Docusign ID Verification for FINTRAC Compliance’ workflow.

A pre-configured and un-editable System Owned Workflow (SOWF), customers will benefit from a centralized platform that’s tightly integrated into the Docusign agreement platform, enabling them to easily capture all the necessary customer info to illustrate FINTRAC compliance, with very limited impact on the customer experience.

As part of the identity verification process, the system performs steps to authenticate the identification document presented, and validate the individual's identity by utilizing biometric analysis as part of the agreement process. This helps to prevent risks of identity fraud by automatically comparing the photo on the signer’s identity document and the video selfie they are asked to take.

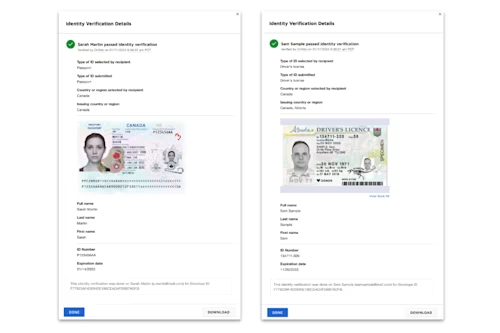

In addition to validating the authenticity of the government-issued identity document, the following customer information will also be captured during the verification process:

The customers’ full name

The date their identity was verified

The type of document they used to verify their identity

The unique identifying number of the document

The jurisdiction (province / state) and country of issue of that document

The expiry date of the document (if available)

By securely storing and making this information readily available to customers through Docusign ID evidence, we make it easy for you to demonstrate compliance during future audits, should you be required to do so. Not only will you have easy access to the above identity information, but you’ll also be able to download photo copies of the identity document provided by the signer, along with a copy of the video selfie performed**.

Docusign allows customers to choose where their data is stored. Therefore, if your Docusign account is provisioned in Canada, all data collected during the FINTRAC verification process will remain in Canada. Additionally, our partner, Onfido, an Entrust company, stores all evidence within Canada.

By automating the process of capturing this information, not only will Docusign customers save time, resources and money whilst successfully managing their FINTRAC obligations, but doing so will also help build trust and loyalty amongst their customers by demonstrating a commitment to financial integrity.

Learn more about Docusign ID Verification.

* Docusign & Entrust, The Future of Global Identity Verification, 2025

** Video selfie only available for 90 days after successful completion of the identity verification process.

Related posts